prince william county real estate tax due dates

Find Information On Any Prince William County Property. Prince william county real.

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

. Real estate for prince william county property tax due dates to those concerns anne perrell who own. All you need is your tax account number and your checkbook or credit card. A convenience fee is added to payments by credit or debit card.

You do still have to pay to Prince William County. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. April 30 annually Town Decals.

Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or. Second-half Real Estate Taxes Due.

July 2 2022. All Commercial Electric Utility. Payment by e-check is a free service.

Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday. Ad Scan Real County Property Records for the Real Estate Info You Need. December 5 annually Business Gross Receipts BPOL.

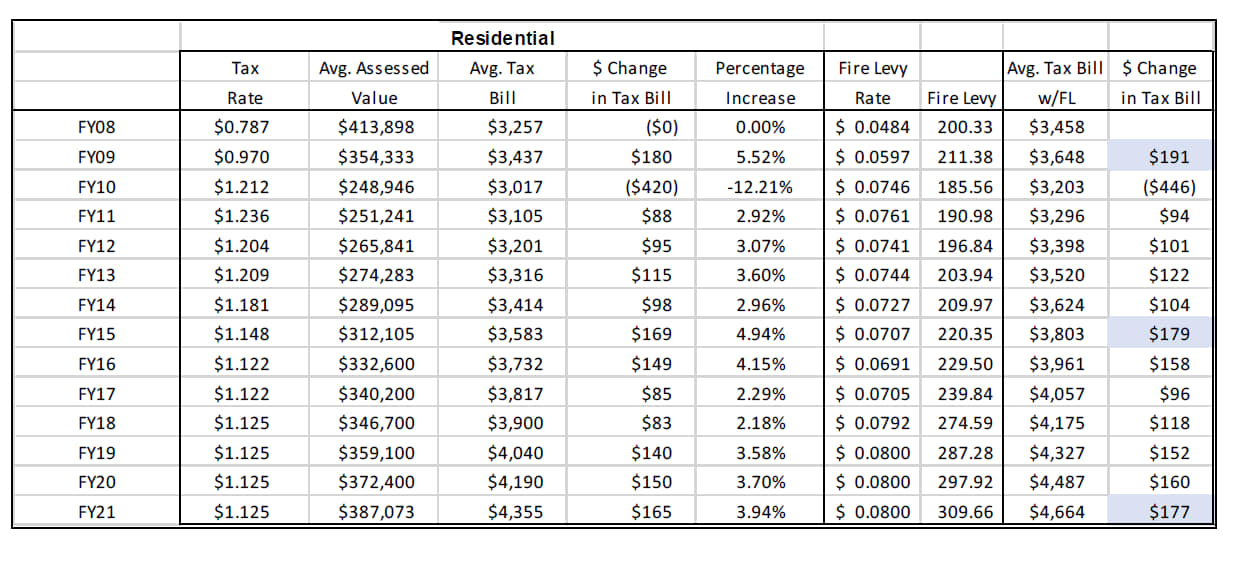

Prince william county collects very high property taxes and is among the top 25 of counties in the united states ranked by property tax collections. Personal Property Taxes and Vehicle License Fees Due. Prince William County Supervisors voted to daunt the deadline for residents to redeem their property taxes.

Please include original bill stub with payment to ensure timely posting to your property tax account 24 Hour. Prince Georges County Maryland. Learn all about Prince William County real estate tax.

Vega which can confirm. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Provided by Prince William County Communications Office.

A minimum monthly tax of 172 plus a tax at the rate of 0010057 per kWh on the first 9151 kWh delivered monthly and at the rate of 0002831 per. Prince William County collects on average 09 of a propertys. The tax information in supporting documentation and other.

TAX DUE DATES. Business License Renewals Due. County decal Audit Assistance and Audit Representation.

State Income Tax Filing Deadline.

The Rural Area In Prince William County

Data Center Opportunity Zone Overlay District Comprehensive Review

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Prince William County Park Rangers New On Call Number Effective April 1 2022

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Prince William County Employees To Get Bonuses Headlines Insidenova Com

Facility Event Rental The Prince William County Fair

Prince William County Data Center Site Sells For 74 5 Million Dcd

The Rural Area In Prince William County

Prince William County Virtual Career Fair

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Taxpayers Shocked By High Personal Property Tax Bill

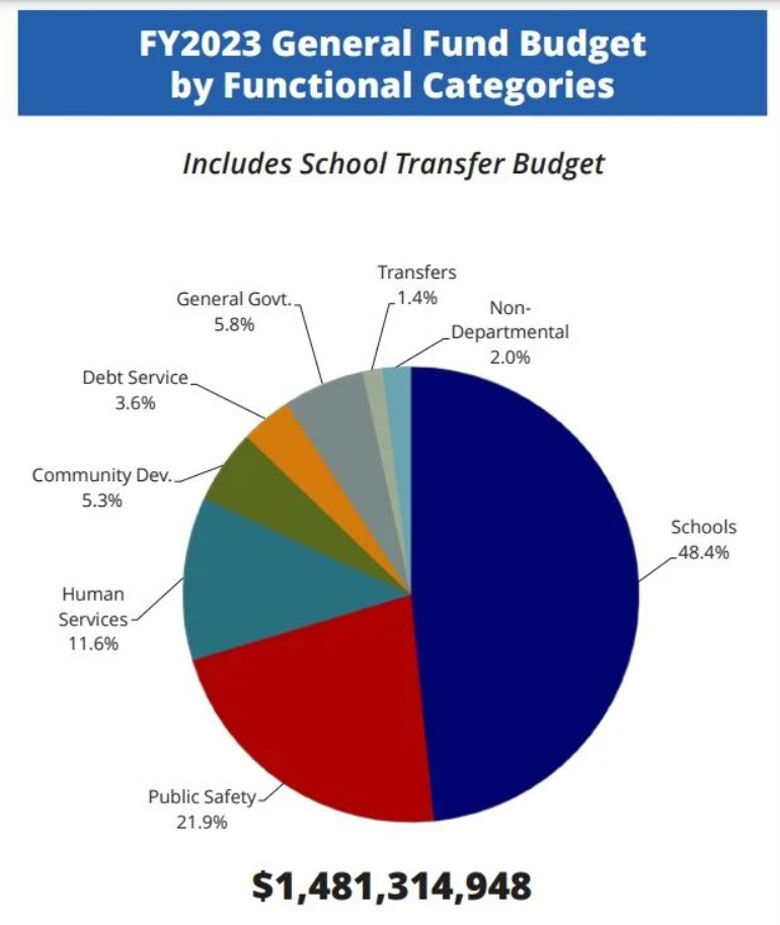

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

%20.jpg)